Code For Trading#

Pandas is an excellent library for analyzing and dealing with data.

In order to calculate profits and how much money to I put into the market, I use a formula after downloading my data from RBC direct investing.

import pandas as pd

data = {

"Activity": {

0: "Buy",

1: "Buy",

2: "Deposits & Contributions",

3: "Withdrawals & De-registrations",

4: "Deposits & Contributions",

},

"Symbol": {0: "BB", 1: "RBF556", 2: "", 3: "RBF558", 4: ""},

"Value": {0: -100.95, 1: -2328.24, 2: 1000.0, 3: -14000.0, 4: 15000.0},

}

df = pd.DataFrame.from_dict(data)

print(df)

deposit_df = df[df.Activity == "Deposits & Contributions"]

divid_df = df[df.Activity == "Dividends"]

with_df = df[df.Activity == "Withdrawals & De-registrations"]

total = deposit_df['Value'].sum() + with_df['Value'].sum()

print(total)

Activity Symbol Value

0 Buy BB -100.95

1 Buy RBF556 -2328.24

2 Deposits & Contributions 1000.00

3 Withdrawals & De-registrations RBF558 -14000.00

4 Deposits & Contributions 15000.00

2000.0

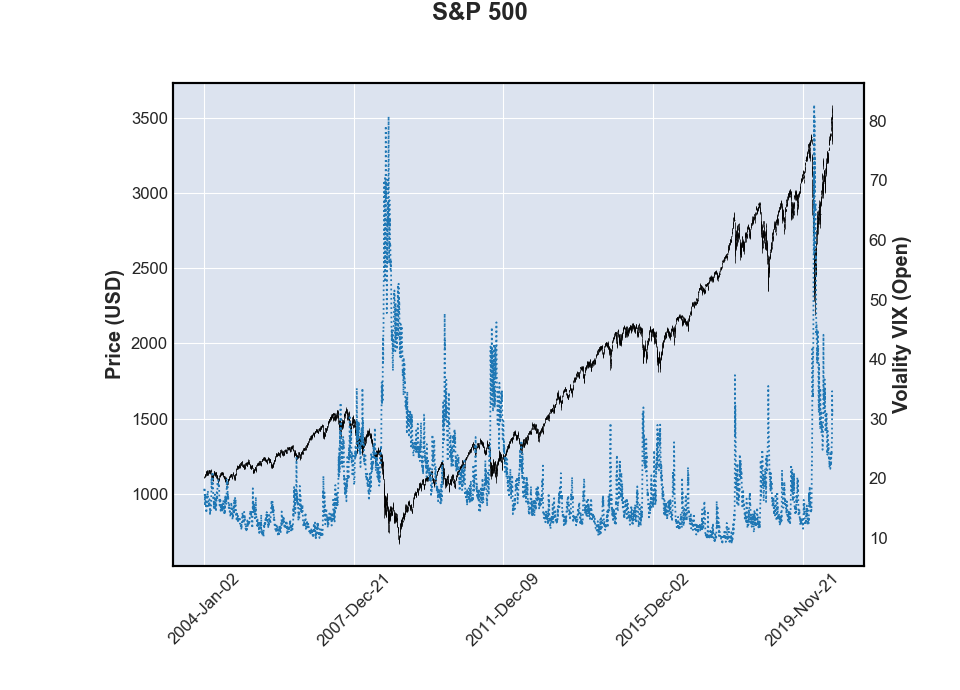

# download files for S&P 500 plot

# http://www.cboe.com/publish/scheduledtask/mktdata/datahouse/vixcurrent.csv

import pandas as pd

import io

import requests

import yfinance as yf

import mplfinance as mpf

# data is only up to 2004

url = "http://www.cboe.com/publish/scheduledtask/mktdata/datahouse/vixcurrent.csv"

s = requests.get(url).content

vix = pd.read_csv(io.StringIO(s.decode("utf-8")))

# VIX Open,VIX High,VIX Low,VIX Close

vix = vix.iloc[

1:,

]

vix.columns = ["Date", "Open", "High", "Low", "Close"]

vix["Date"] = pd.to_datetime(vix["Date"].astype(str), format="%m/%d/%Y")

# vix.rename(columns={"VIX Open": "Open", "VIX High": "High", "VIX Close": "Close"})

vix[["Open", "High", "Close"]] = vix[["Open", "High", "Close"]].apply(pd.to_numeric)

vix = vix.set_index("Date", drop=True)

vix.to_csv("vix_curr.csv", index=True)

sp = yf.Ticker("^GSPC")

# Consider grabbing for valid date index instead

history = sp.history(start="2004-01-02")

apds = [

mpf.make_addplot(vix.Open.values, linestyle="dotted", ylabel="Volality VIX (Open)"),

]

fig, axes = mpf.plot(

history,

addplot=apds,

ylabel="Price (USD)",

returnfig=True,

figscale=1.2,

title="S&P 500",

)

axes[0].legend(["S&P500", "VIX"], loc="upper left")

fig.savefig("vix_vs_s&p500.png")

Which produces the following image

If the vix is spiking way above the graph and the s&p500 is low, then it is an excellent time to buy.

Thoughts on algorithmic trading#

Some of the assumptions made during algorithmic trading are fairly interesting

You can focus on either internal events or external events (like covid19).

You assume the stock price fully prices in earnings and revenue projections (not always accurate), especially for small caps.

An reinforcement algorithm only attempts to make the “right” decision and not predict the price.