Stock Purchases Thoughts#

12/05/2020 If you have no idea what you are doing, rely on charts and TA, it can tell you a good time to sell.

Never underestimate FOMO

11/11/2020

MTRX loop insights - spiked to 0.50 - shouldn’t have sold

DCM - epic report good buy

PKK - went down a bunch still a decent buy with a zack report at 3.8 USD - 5.0 CAD

ART - down should be knee jerk reaction

BEE - should recover with other pandemic stocks looking promising 100% retention must have good product and good peope

CGX - sold cause movie theatre - day trade

11/09/2020

MTRX loop insights video mentioning pfizer, why the heck did I sell it. Was this a good idea? probably not.

Bought DCM - should be up 10x and peak should be up 10 x.

Diversification - perhaps should have just spent more money instead.

Split advice by year eventually 10/28/2020

Stock market crashing dont feel like selling

CMC.CN - Needs to hit targets and shit the facilities built

PKK.CN - main focus on china not covid center spot

IDK.CN - nav of 0.41 usually stocks trade 2x nav and pkk.cn + mtrx doing well this year

MTRX.CN - contact tracing, if adopted should do well

ART.V - business does well in covid19

Can trim some loop on the uptick 10k shares, same with cielo, 40k shares

10/23/2020 Peak to aphria

shouldn’t have fucking sold

Peak still growing

Pot not tech, can’t grow fast aphria thoughts, if biden wins, harris pot decriminalization in america, temp surge, dump aphria, buy arht?

10/11/2020

Doubling down on peak as some guy in ceo.ca/pkk posted an article about china growing. They have control of the virus, it makes sense to invest in a country that is growing that is not in the state, espeically if they believe they are severely undervalued with high margins and the opportunity to give a dividend.

In addition, sheldon has a position in pkk.

Cielo seems to be doing well, if production numbers are 1000 L/h (pretty high), I would expect 100x return sometime in the future. After all, they have done the work to start growing like crazy as plastic production is projected to increase and there is no solution as good as cielo at the moment.

09/13/2020 KUU MIGHT BEINSOVLENT Wait on BYL for 5G

Think about VIS.V if it makes 334,250 as projected in Q4

The stocks I looked at recently that were interesting as of 09/15/2020

Ticker |

Long Name |

|---|---|

PAI |

Predictiv AI Inc. |

RW |

RenoWorks Software Inc |

DFT |

Dimension Five Technologies Inc |

KUU |

Kuuhubb Inc |

BYL |

Baylin Technology Inc |

CMC |

Cielo Waste Solutions Inc |

09/08/2020

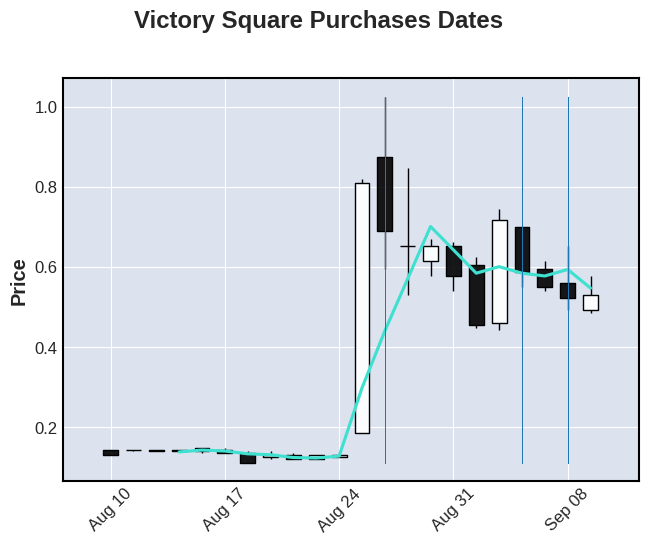

import yfinance as yf

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

import mplfinance as mpf

vst = yf.Ticker("VST.CN")

data = vst.history(interval="1d", start="2020-08-08", end="2020-09-10")

mpf.plot(

data,

type="candle",

mav=4,

title="Victory Square Purchases Dates",

vlines=dict(

vlines=["2020-08-26", "2020-09-03", "2020-09-08"], linewidths=(0.5, 0.5, 0.5)

),

)

The first few purchases on August 26 and September 03 were profitable, after the failed Sept 08 purchases and surprise drop I emailed the investor relations guy asking about india approval.

My brief calculations of the covid-19 test selling well make me think if they sell well (80 %), the stock will continue the rise.

The combination of covid-19 increasing, the need to know if you were previously infected for health care workers perhaps even vaccines, make me think that the stock will go up in the short term in the next few months.

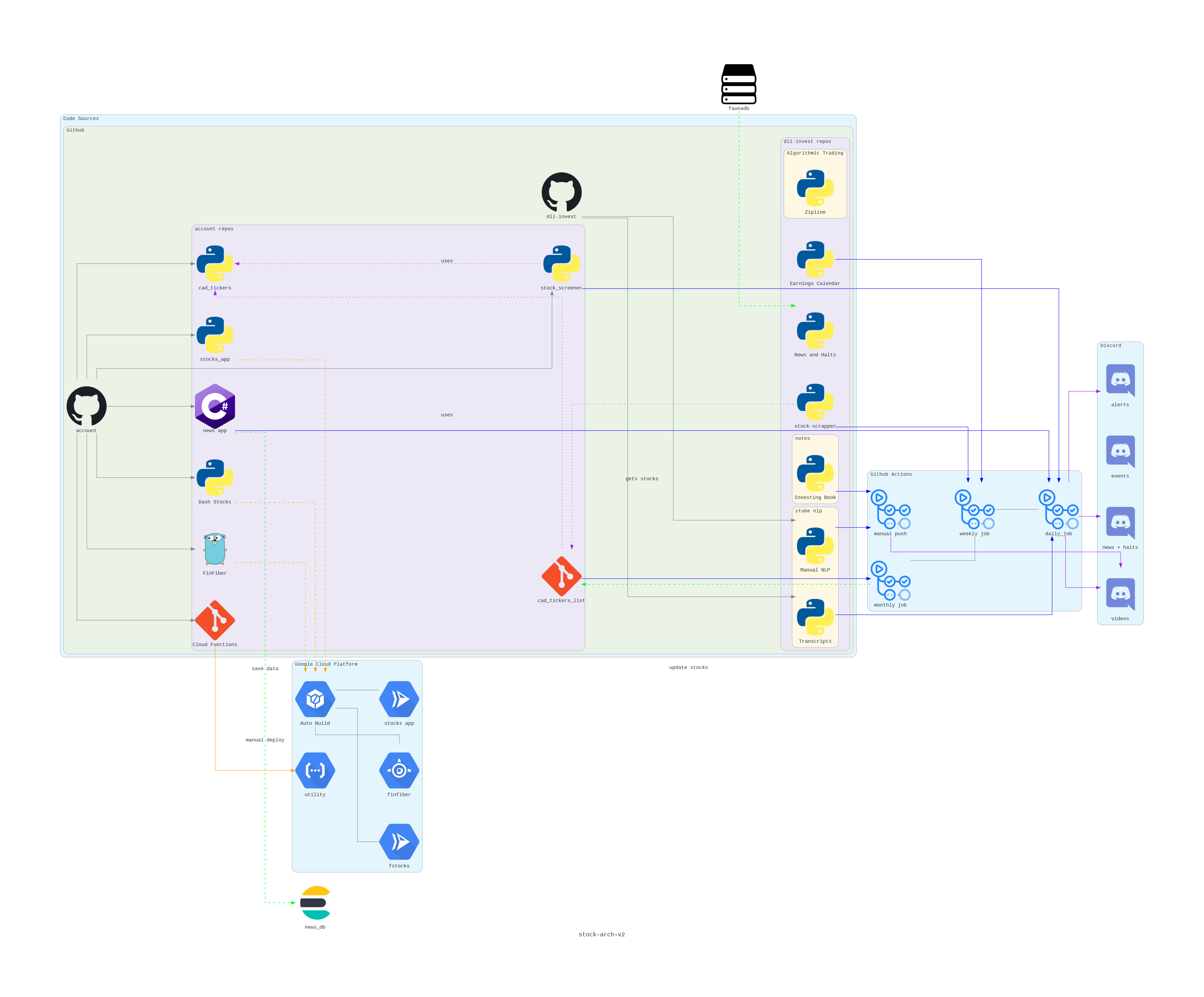

Cloud Architecture V1#

Since diagrams added a bunch of nodes, I can now fully diagram my current stock market CI/CD pipelines and tools.

To run on colab install graphviz

!pip install graphviz

!apt-get install graphviz

Install the diagrams package

!pip install diagrams

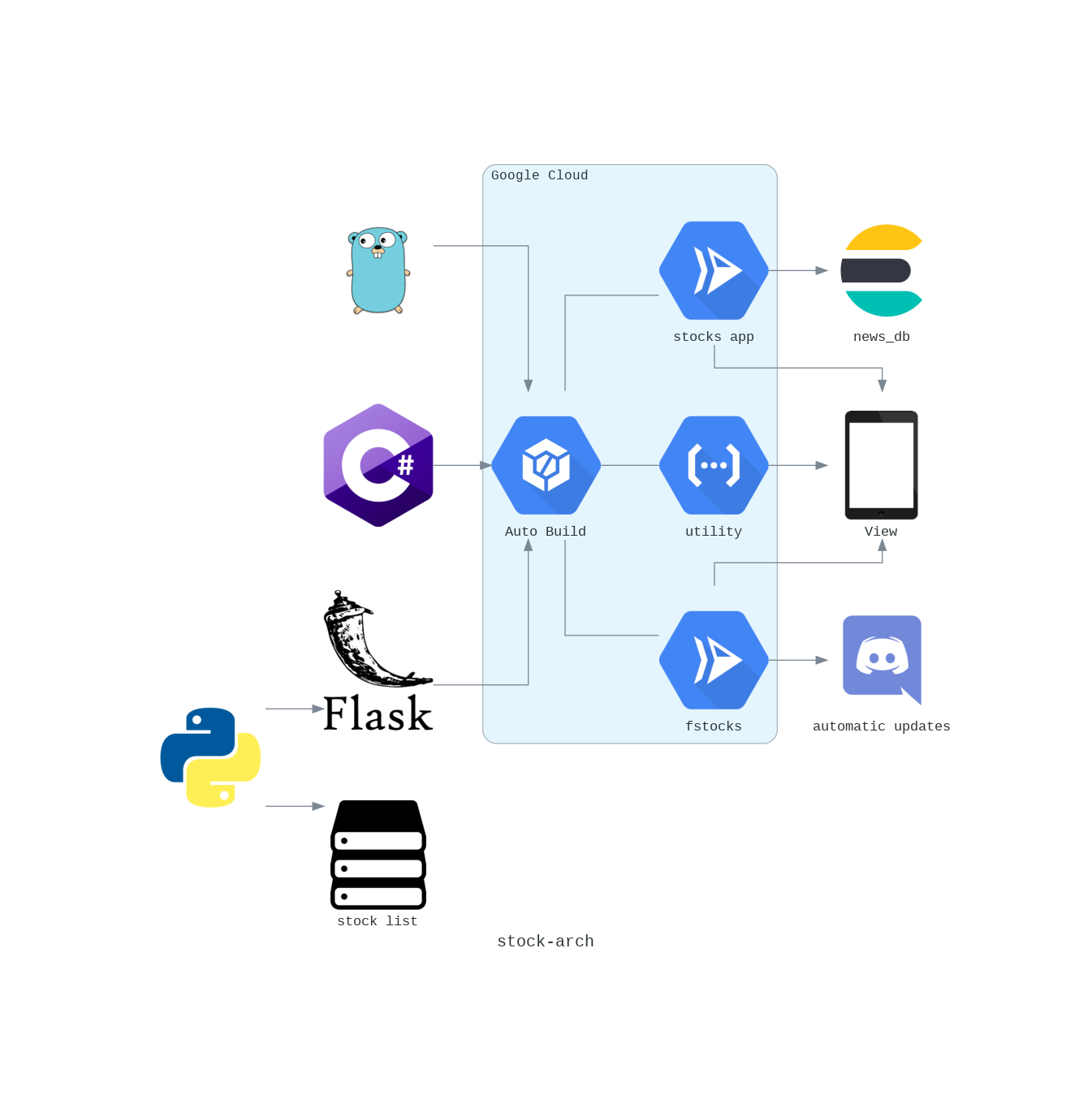

Cloud Architecture V0#

Make this seperate chapter

As for sept 28 2020

my basic cloud archtecture was based on gcp. Primarily using google cloud build for automated deployed and the various serverless compute options. Aimed to stay within free tier but sometimes I paid cash for this (TODO make a blog post about my stocks hosting stuff).